+ Princeton Architectural Press

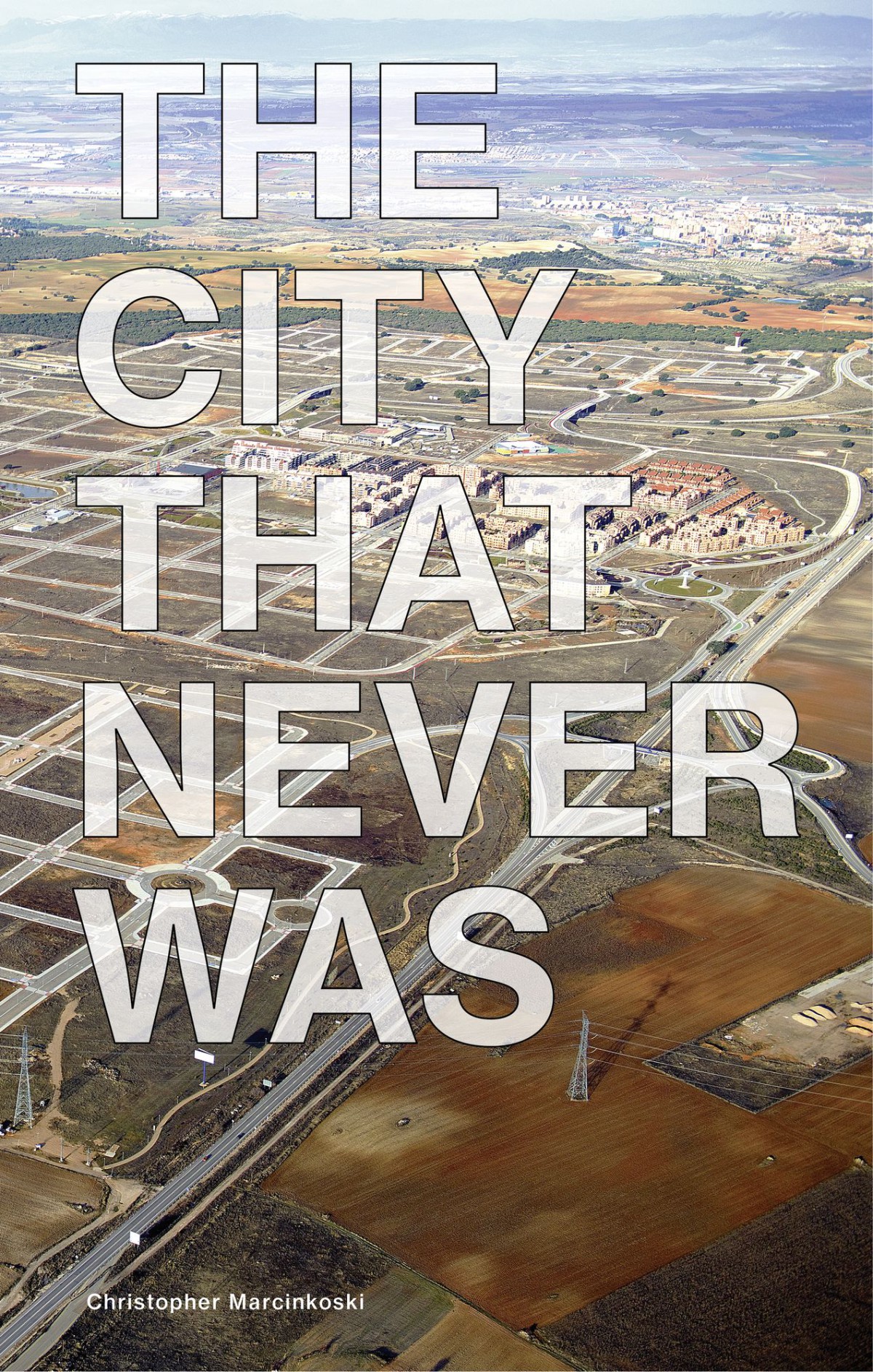

One of the most troubling consequences of the–2008 global financial collapse was the midstream abandonment of several large-scale speculative urban and suburban projects.The resulting scars on the landscape, large subdivisions with only marked-out plots and half-finished roads, are the subject of The City That Never Was, an eye-opening look at what happens when development, particularly what the author calls “speculative urbanism,” is out-of-sync with financial reality. Presenting historical and recent examples from around the world—from the sprawl of the US Sun Belt and the unoccupied towns of western China, to the “ghost estates” of Ireland—and focusing on case studies in Spain, Marcinkoski proposes an ecologically based model in place of the capricious economic and political factors that typically drive development today.

Princeton Architectural Press

The City That Never Was is as an intensive study on the nature, manners and challenges of contemporary speculative urban design. Below you can read an excerpt from the book.

A Brief History of Speculative Urbanization Those that were addicted to building would undo themselves soon enough without the help of other enemies. —Marcus Licinius Crassus, Plutarch’s Lives of the Noble Greeks and Romans Over the last two decades, speculative urbanization has emerged as one of the most influential and consequential aspects of urban migration and economic modernization worldwide. While this has meant an enormous amount of new building, it has also precipitated significant socioeconomic and environmental consequences. As a result, the increasing proliferation of speculative urbanization activities has considerable implications for the urban design disciplines actively participating in this work. After the 2008 global financial crisis, the role of banking and real estate investment policy changes came under scrutiny. These policy shifts had allowed for new financial tools—increasingly complex transactional instruments—designed to connect local real estate markets with the broader global capital market through securitization.1 Phrases such as mortgage-backed securities, collateralized debt obligations, derivatives, credit default swaps, and too big to fail became part of our everyday lexicon. Along with the accelerated nature of contemporary media, it implied that the fundamental events that led to this most recent economic crisis are somehow exceptional in history. They are not. Though its intensity and extent could be characterized as unique, the phenomenon that led to the 2008 financial crisis should be familiar. Real estate speculation—in particular, the speculative expansion of settlement—has been seen throughout history in varying forms and political, geographic, and economic contexts. Liberalized banking policies enacted globally over the last thirty years have certainly contributed to the increase in scale and frequency of these speculative events, but there are too many other variables in play to implicate solely the activity of financial markets. For example, little attention has been paid to the role of the design and planning disciplines in elaborating the urbanization initiatives on which these financial transactions rely, such as gated suburban housing compounds, iconic high-rise commercial office towers, vast cultural venues, and state-of-the-art mobility infrastructures. Thus one of the most overlooked aspects of the recent global economic crisis is the part architecture, landscape architecture, and urban planning played in the production of this particular episode. This oversight should be no surprise. Real estate speculation has traditionally been thought of as an economic concern. Where there has been significant social and political consequence, scholarly consideration of speculation has moved into the realm of sociology, geography, and political science. Rarely does real estate speculation ever enter into design or planning theory or discourse—beyond passive critique—despite the central role these disciplines play in its conception. Given recent circumstances, perhaps it is time for urban design to pay greater attention to the motivations, products, and consequences of the more significant speculative events seen throughout history. The purpose of this chapter is to explore a range of historical and ongoing examples of speculative urbanization—from various geographic, political, and economic contexts—to establish it as an essential disciplinary concern of contemporary urban design praxis. Speculation has been defined and understood from a variety of perspectives over time. Many contemporary social geographers like David Harvey, Erik Swyngedouw, and Neil Brenner rightly note that the expansion of neoliberal development policies and banking deregulation in the 1980s led to the most recent period of speculative building and subsequent crisis.2 Decades earlier in the 1940s, the historian Paul Wallace Gates had shown how similarly loose banking policies in the 1800s made credit comparably easy to secure for frontier speculators then operating in the western United States.3 Behavioral economists like Yale’s Robert Shiller cite psychological irrationality, or a “herd mentality,” as a potential cause of these events. Enthusiasm for prospective financial success or, alternatively, the fear of missed opportunity spreads like a contagion, amplifying the appeal of a speculative opportunity despite commonsense doubts about its viability.4 Another behavioral economist, Hersh Shefrin, in a recent essay notes that human “psychological profiles predispose... markets to generate [speculative] bubbles.”5 In other words, speculation is simply human nature. For economic historians like Douglas North, speculation is “endemic” to capitalist-driven economies.6 However, so-called Chicago School economists like Eugene Fama—originator of the efficient markets hypothesis—suggest that speculative bubbles do not even exist. Rather, these “bubbles are twenty-twenty hindsight,” episodes that emerge as a result of external events like recessions or the Great Depression.7 Indeed, Harvard’s Edward Glaeser has demonstrated that what may seem irrational in hindsight may not have been all that irrational at the time.8 Earlier theories on the root of this phenomenon are also worth considering. The land economist Homer Hoyt looked at land values in Chicago throughout the nineteenth century to demonstrate the relatively cyclical nature (every eighteen years) of rising prices for property development.9 The political economist Henry George contemplated the implications of, and potential control mechanisms afforded by, property taxes on land speculation tied to westward expansion of railroads in the United States near the end of the nineteenth century.10 The scholarship mentioned above provides a well-argued and well-substantiated logic, yet they have their faults and detractors. Consensus on the phenomenon of speculation simply does not exist. My interest here is not to construct another interpretation as to why speculation occurs—I leave that to other disciplines and scholars. Rather, I am interested in the significance of these recurring speculative expansions of settlement. And more specifically, I am interested in what the implications of this recurrence are for contemporary urban design and planning praxis amid their increasing involvement in such activity. While widespread and deep disagreement over the origins of speculative urbanization will continue to exist, a survey of scholarship investigating a source logic of speculation does provide us with one concrete conclusion: the speculative expansion of settlement will continue in perpetuity, and any suggestion otherwise should be met with the utmost suspicion. One source of this disagreement may emerge from the definitions of bubble and speculation that scholars use. In reality, these terms are often used interchangeably and have continued to shift in meaning over time.11 For my purposes, the definition of bubble is less important than how one understands the notion of speculation. The term bubble has to do with an evaluation of an event or episode made in hindsight. Speculation, in contrast, is something that design and planning have been, and will continue to be, actively engaged in for the foreseeable future. No one endeavors to inflate the value of an asset to a point of collapse. But it is common—perhaps even inevitable—to speculate on real estate. What these two terms do share, however, is an implication of volatility, uncertainty, and risk.12 Engaging this inevitability might offer a fresh way to negotiate the increasingly speculative nature of contemporary urbanization initiatives. Speculative urbanization refers to the construction of urban infrastructure or settlement for political or economic purposes, rather than to meet real (as opposed to artificially exaggerated) demographic or market demand. It also includes the legislative redesignation and reparcelization of land to increase its monetary value. Speculative urbanization frequently occurs at the periphery and in the margins of already urbanized areas but can also emerge in undeveloped greenfield contexts. Most often driven by the pursuit of financial gain, these speculative endeavors are also compelled by political ambitions as demonstrations of power and progress. This definition borrows from Henri Lefebvre’s The Urban Revolution and its understanding of urban as the tenancy of any territory for the specific purpose of advancing anthropogenic concerns at the expense of the environmental condition of that territory. Here urbanization is not simply the product of capital; rather, it is employed in creating the conditions for the possibility of capital.13 In this sense, the phenomenon of speculative urbanization is everywhere—from the core of a global city to the rural hinterland of the global South. Given the recurrent nature of this phenomenon, and the limited attention paid to the role that design and planning have or have not played in these events, it is worth considering the historical arc of these episodes. How have these speculative endeavors changed in terms of their orientation, their associated products, and their social and economic consequences? Of particular interest is the gradual shift from urbanization as a response to economic growth to urbanization deployed as a driver of economic growth—a variant on what Harvey has described as “capital switching.”14 In reviewing the antecedents described below, it should become clear that urbanization has become the preferred instrument of economic production and expression of political power in both established and emerging economies. As such, it is essential to consider the implications of this reality for the planning and design professions that participate in the production of this urbanization. Or, to paraphrase Gates, while one may disagree with the motives, there is little doubt that these speculative endeavors profoundly shape the land and cultural patterns of the geographies where they occur.15 1 John R. Logan, “Gambling on Real Estate: Limited Rationality in the Global Economy,” Sociological Perspectives 34, no. 4 (1991): 394. 2 See David Harvey, “The Right to the City,” New Left Review 53 (September– October 2008), http:// newleftreview.org/II/53/ david-harvey-the-right-to- the-city; Erik Swyngedouw, Frank Moulaert, and Arantxa Rodriguez, “Neoliberal Urbanization in Europe: Large-Scale Urban Development Projects and the New Urban Policy,” Antipode 34, no. 3 (2002): 542–77; and Neil Brenner and Nik Theodore, “Cities and Geographies of ‘Actually Existing Neoliberalism,’” Antipode 34, no. 3 (2002): 349–79. 3 Paul Wallace Gates, “The Role of the Land Speculator in Western Development,” Pennsylvania Magazine of History and Biography 66, no. 3 (1942): 312. 4 Robert Shiller, Irrational Exuberance, 2nd ed. (Princeton, N.J.: Princeton University Press, 2005), 149–73. 5 Hersh Shefrin, “What Eugene Fama Could Learn from His Fellow Nobel Winner Robert Shiller,” Forbes, October 17, 2013, http://www.forbes.com /sites/hershshefrin/2013 /10/17/my-behavioral-take -on-the-2013-economics -nobel/. 6 Douglas North, Growth and Welfare in the American Past: A New Economic History, 3rd ed. (Englewood Cliffs, N.J.: Prentice-Hall, 1982), 132. 7 John Cassidy, “After the Blowup: Laissez-Faire Economists Do Some Soul- Searching—and Finger- Pointing,” New Yorker, January 11, 2010: 28–33. 8 Edward Glaeser, “A Nation of Gamblers: Real Estate Speculation and American History,” American Economic Review: Papers and Proceedings 103, no. 3 (2013): 17. 9 Homer Hoyt, One Hundred Years of Land Values in Chicago: The Relationship of the Growth of Chicago to the Rise in Its Land Values, 1830–1933 (Chicago: University of Chicago Press, 1933). 10 Henry George, Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy, 50th anniversary ed. (New York: R. Schalkenbach Foundation, 1953). 11 See, for example, Richard T. Ely, “Land Speculation,” Journal of Farm Economics 2, no. 3 (1920): 121; Gates, “Role of the Land Speculator,” 315; Peter M. Garber, “The Bubble Interpretation,” in Famous First Bubbles (Cambridge, Mass.: MIT Press, 2000), 314; and Cassidy, “After the Blowup.” 12 Mason Gaffney, “The Role of Land Markets in Economic Crises,” American Journal of Economics and Sociology 68, no. 4 (2009): 855–88. Economist, December 18, 2008, http://www.economist. com/node/12792903/. 13 Henri Lefebvre, The Urban Revolution, trans. Robert Bononno (Minneapolis: University of Minnesota Press, 2003), 3–15. 14 David Harvey, “The Urban Process under Capitalism: A Framework for Analysis,” International Journal of Urban and Regional Research 2, nos. 1–4 (1978): 101–31. 15 Gates, “Role of the Land Speculator,” 333.